SPLOST FAQs

WHAT IS A SPLOST?

The Special Purpose Local Option Sales Tax (SPLOST) was enacted by the General Assembly in 1985. The SPLOST was conceived and enacted as a county tax for funding capital projects. It is not a municipal tax, nor is it a joint county-municipal tax like the regular Local Option Sales Tax (LOST). As a county tax, a SPLOST can only be initiated by the county governing authority.

WHAT IS THE PROCESS FOR DECIDING HOW THE SPLOST FUNDS WILL BE SPENT?

State law determines how the SPLOST proceeds must be spent and DeKalb will comply with the rules.

HOW LONG CAN A SPLOST LAST?

Several factors determine the length of time that a SPLOST may be imposed. In general, the tax may be levied for up to five years. If a county and the municipalities within that county enter into an intergovernmental agreement to have a SPLOST, the tax may be imposed for six years.

WHO ESTABLISHED THE REVENUE ESTIMATES FOR SPLOST?

The County is responsible for estimating the SPLOST revenues expected to be collected over the life of the SPLOST, as well as the costs of all County projects to be financed. Each city is responsible for estimating the cost of all City projects.

HOW MUCH DETAIL IS REQUIRED IN THE SPLOST REFERENDUM?

The SPLOST law requires that the purpose or purposes (i.e., the capital outlay project categories) for which SPLOST revenues will be used be written on the ballot. The degree of specificity is left to the county and municipalities imposing the SPLOST.

WILL SPLOST, EHOST AND HOST BE ON THE BALLOT?

Yes. Citizens will vote on whether to approve a second 6-year SPLOST and whether to continue the suspension of HOST and replace it with an EHOST.

WHAT PROJECTS CAN THE SPLOST FUNDS BE SPENT ON?

There are 14 categories of permissible expenditures under the SPLOST law. In general SPLOST proceeds can be used to fund capital outlay projects defined by law as major, permanent, or long-lived improvements or betterments to the County such as land and structures which fall within one or more of the 14 categories.

WILL THERE BE A LIST OF PROJECTS?

Yes, the ballot question that voters will consider includes the project categories.

EHOST FAQs

WHAT IS EHOST?

The Equalized Homestead Option Sales and Use Tax (EHOST) is a one percent sales and use tax used to provide property tax relief for homeowners. Proceeds from EHOST are 100% dedicated to rolling back property taxes on homestead exempt properties.

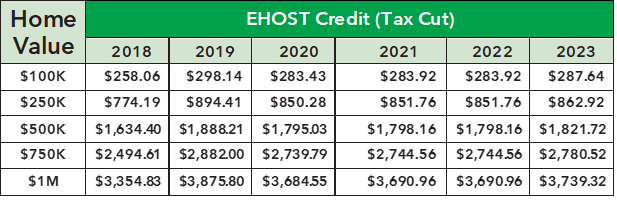

HOW MUCH WILL I SAVE ON MY HOME’S TAX BILL IF THIS PASSES?

This amount will vary depending upon several factors including the value of your home, the millage rates, and any other tax exemptions on your home. The table below shows the estimated Equalized Homestead Option Sales and Use Tax (EHOST) tax savings since 2018 based on homes with the basic homestead exemption by the fair market value of the home:

MUST BOTH THE EHOST AND THE SPLOST PASS AGAIN FOR EITHER ONE TO CONTINUE?

Yes. Unless BOTH the Equalized Homestead Option Sales and Use Tax (EHOST) AND the Special Purpose Local Option Sales and Use Tax (SPLOST) are approved, then neither the EHOST nor the SPLOST tax shall become effective.

DeKalb SPLOST II Community Meetings

June 21, 2023 SPLOST II Community Town Hall Meeting

June 22, 2023 SPLOST II Community Town Hall Meeting

June 28, 2023 SPLOST II Community Town Hall Meeting

July 12, 2023 SPLOST II Community Town Hall Meeting